SIR met the Secretary General of the Italian Bishops’ Conference, Monsignor Giuseppe Baturi, a few days ahead of the start of the tax filing season.

Your Excellency, why does Italy’s legal framework stipulate a minimum share of taxes devolved to the Italian Church?

In the legal systems of all Western countries, especially in Europe, funds are allocated not only to the Catholic Church but also to other organised religions. In Italy, it is not a just a question of funding, but of allocating a portion of income taxes for purposes that aim to meet a person’s primary needs, constitutionally guaranteed and enshrined in the law. Fulfilling these purposes is likewise entrusted to the Church.

It is not a way to fund the Catholic Church. It is a free option available to citizens who choose the recipient that in their view meets the purposes set out by the law.

Arguing otherwise is a very serious distortion: the Church cannot allocate the sums as she pleases. The purposes must be those specifically determined.

What are they?

Worship and pastoral ministry, support for the clergy and charitable activities for the national community and the Third World. The sums cannot be used for purposes other than those specified and, therefore, it is not an undetermined form of funding for the Church, but rather a way of giving religious faiths the means to achieve specific ends according to taxpayers’ free choices.

How did the ‘Eight per Thousand’ tax scheme take shape?

It was established following the 1984 revision agreements of the Lateran Concordat in accordance with the provisions of Law n. 222/1985. The intention was to replace the two existing sources of sustenance for the Catholic Church in the State budget, destined to religious buildings, along with the congrua for parish priests. This system proved to be poorly structured, with serious limitations in terms of justice and fairness. A comprehensive revision was thus carried out, giving Italian taxpayers the opportunity to choose. It should be remembered that at the time, it was not even known to what extent the latter would opt for it.

It was a free choice offered by the State, not dictated by an economic advantage.

A democratic option, offered by a secular society that does not reject religiosity but rather supports it.

What is the situation in other countries?

The legal systems of other countries likewise envisage some forms of support, although it should be noted that Italy’s is the most controlled. For example, in German-speaking countries, the State simply complies with ecclesial tax regulations. By contrast, Italian taxpayers are not burdened in any way for purposes that benefit the community as a whole.

Occasionally, the ‘Eight per Thousand’ taxpayer contribution is portrayed as the State’s benevolent concession to the Italian Church….

The State has a favourable inclination towards solidarity and subsidiarity. This is guaranteed by entrusting the Church with the necessary resources to meet those objectives. One of the novelties provided for by the “Eight per thousand” system is having ensured a benefit for all. Even religion-based organisations can carry out charitable and outreach activities for the benefit of the community and third world countries.

The Italian Church devolves approximately one third of its resources to help indigent persons, migrants, homeless persons, persons requiring medical care, and the poorest. This amounts to over €200 million a year.

Does it serve as an incentive to promote third sector initiatives?

Indeed, it does. According to the data, the ‘Eight-per-thousand’ taxpayer contribution for the Church or other religions has acted as a strong stimulus to increase community welfare and solidarity activities. This sector’s growth proved decisive in combating social deterioration. Moreover, it prompted greater creativity and responsibility on the part of Italian citizens. It is a very important participatory tool.

The growth of social and healthcare undertakings of the Church occurred with the establishment of the ‘Eight per Thousand’ tax scheme.

This is an advantage not only for the beneficiaries, but also for whoever has social responsibilities in partnership with other entities, creating projects, providing services, participating in building the common good.

Do you agree that acts of benevolence are not so much for those who receive but for those who give?

Thanks to the ‘Eight-per-thousand’ taxpayer contribution scheme, concrete support can be offered to persons in need, with the creation of new services. This benefits also the givers. It should be remembered that welfare in Italy is determined also by this community and solidarity network. The ‘Eight-per-thousand’ taxpayer contribution scheme was the first tool of fiscal democracy, allowing citizens to decide the recipients of a portion of their income destined for the tax office.

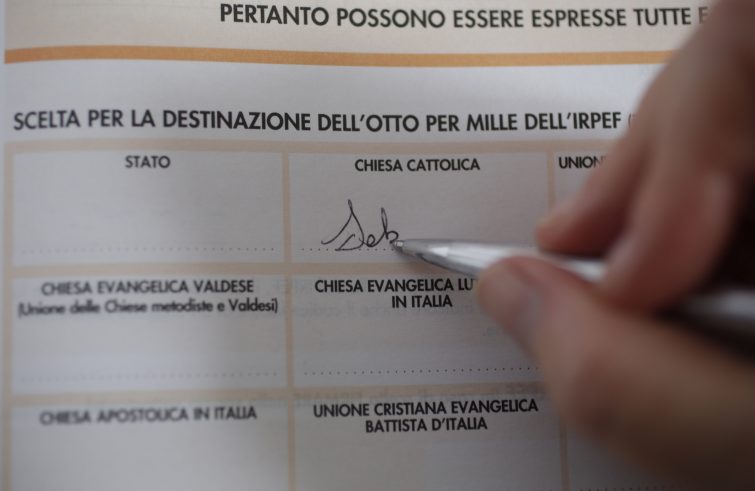

Why is it important to sign for this contribution in the tax return form?

The fundamental values of the ‘Eight per thousand’ taxpayer contribution should be rediscovered: the common good, solidarity, believers’ participation, and financial support for churches in their mission. By contributing to the Eight per thousand programme taxpayers contribute to the dissemination of its values, the understanding of its lofty values – one of the reasons why even certain Eastern European legal systems, in the aftermath of the fall of the Berlin Wall, drew inspiration from Italy.

There is no such thing as an Italian anomaly. As a matter of fact, our legal system is seen as a role model compared to other legal systems. Yet more information is needed, it is necessary to understand the value it holds for all – believers and non-believers alike – in terms of solidarity and democracy.

Numerous ‘Eight per thousand’ projects are implemented abroad.

Under the Italian law, the Bishops’ Conference in Italy has the possibility to devolve a share of charitable donations to poor countries. We have consistently increased this share over the past few years, now amounting to EUR 80 million per year. This means that these resources are used to finance over 700 projects that benefit the countries with the lowest GDP, in compliance with the OECD classification.

You have recently visited Lebanon and Syria. What realities did you discover?

I have seen some extraordinary things: healthcare, education projects and projects to combat poverty. I saw people being taken care of in the midst of war, aggravated by the earthquake and the financial crisis. The Catholic Church’s ‘Eight per thousand’ contributions triggered local energies in terms of volunteering and co-responsibility. To put it another way: it saved human lives. Now the poor can access healthcare, something that would otherwise have been impossible. Soup kitchens in Aleppo serve the poor 1,500 meals a year.

The Eight per thousand taxpayer contribution makes the difference between life and death.

Work well done in Rome saves human lives all over the world. Half of the funds are allocated to projects in Africa, in one of the territories most severely impacted by the economic fallout from the war in Ukraine caused by the grain blockade or delays. A huge and often unnoticed amount of charity work is underway, not least to stem the migratory flows that put so many people’s lives at risk.

Yet controversies tend to flare up time and again….

The Eight per thousand tax contribution does not benefit the Catholic Church. If anything, it benefits the pursuit of constitutionally guaranteed rights, and it concerns everyone. It saddens me to see controversies played out at the expense of the poor, ignoring the benefits of the resources made available. There is a tendency to inflame emotions, losing sight of reality. I invite everyone to spend half a day with us to see for themselves. I am sorry for the polemics that are conducted on the skin of poor people, without looking at the effects of the resources made available. There is a tendency to stir up emotions, losing sight of reality. I encourage everyone to spend half a day with us and see for themselves that the Eight per thousand contribution benefits so many people who would otherwise have no help at all. Do come and see for yourselves.